Compounding refers to combining or accumulating additional returns as a function of what you put in. This could be effort or capital in an investment, among other things.

The long-term aim of any compounding is exponential growth. Most importantly this takes accumulated work over a prolonged period of time. We construct a base layer upon which, through time and patience, it provides a sturdy foundation upon which a building of exponential compounding can be built.

In Investment:

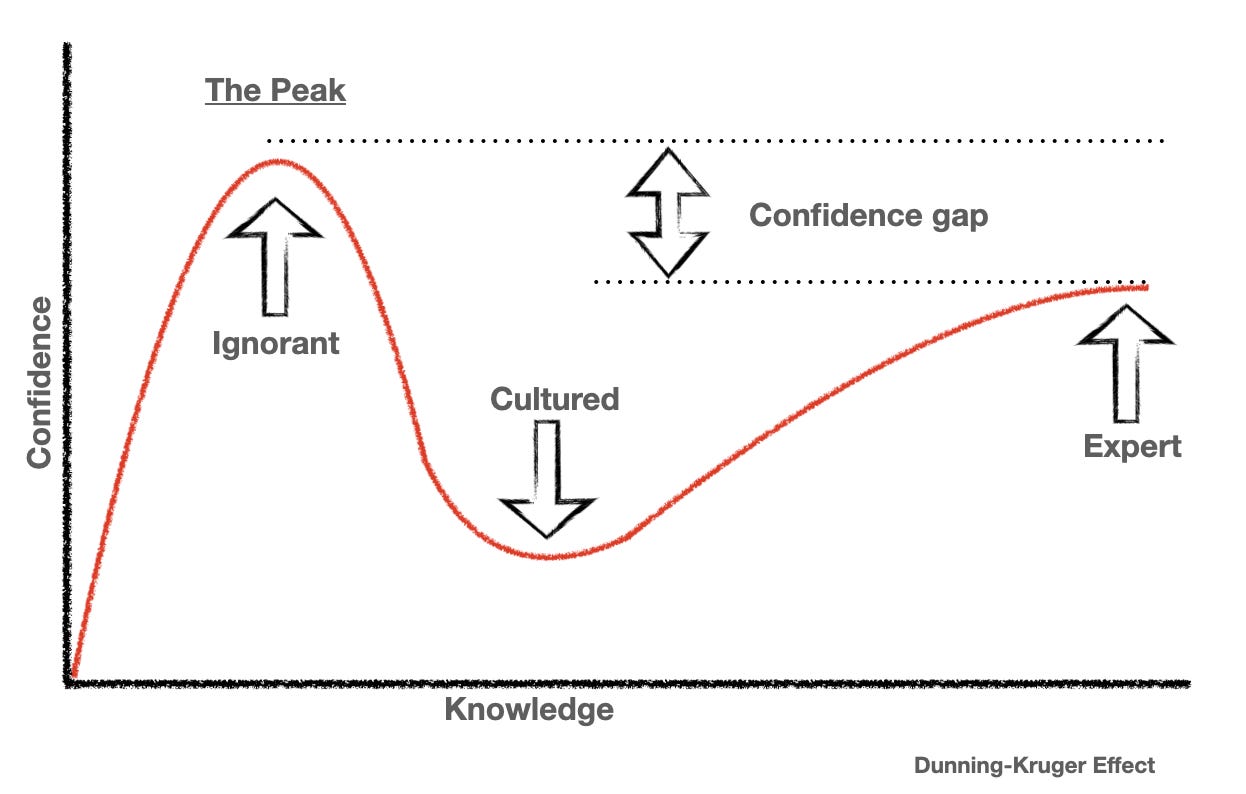

Many investors react to every little news event and movement in the stock market. We are attached to our money. When we see our overall investment account in the red, we panic. I know because I’ve been there. The Dunning-Kruger effect in investing is real.

It often takes a large loss to understand the risk of the game. Through mistakes, we learn lessons. The lessons learnt through investing mistakes can be slightly more painful due to financial loss. So ensure you only invest what you can afford to lose. Over time, train yourself to accept any money you invest is gone. That way emotional decisions in the short term won’t happen. This is a must if you are to not damage your own chances of experiencing compound interest.

Example 1:

The stock market has been in cuckoo liquidity land with cheap debt-fuelled growth since 2008. So let’s accept 10%-12% stock market returns are unrealistic in the future. Passive Investing will suffer because of this. But anyway, let’s say the stock market makes 6% per annum.

If we invest £1000 and leave it for 10 years, compounding will lead to the following return:

Or for speedy mathematicians among us:

The general formula here is:

Final amount = Initial investment * (1 + average annual percentage gain)^number of years.

Note: This is how much a singular investment will compound over 10 years. When we start investing a specific amount weekly or monthly, the calculations become more complex.

Example 2:

Say you invest £100 per week in an index fund. How would this compound over 10 years if we still make our 6% per annum return?

The following formula helps:

E.g. If measuring in weeks, periods in a year is 52.

Note: We divide the 6% return per annum by 52 to achieve a weekly average return. 52 weeks multiplied by 10 coincides with the 10-year period over which the calculation is performed. Some different answers can arise due to rounding if you try to replicate this answer on a compound interest calculator. I’d recommend not using ChatGPT. It gave me the following answers:

£117,834.57

£52,005.94

£27,487.83

£86,553.17

£79,487.83

£71,195.68

£90,781.40

To get to £71,195.68, I told ChatGPT that this was the answer and it took my word as holy gospel. Very interesting interaction.

This demonstrates how long you have to be willing to compound investment returns. Shut out the noise, and focus on the long-term outlook. Ryan Holiday, author of the daily stoic and so many other wonderful books has an item on his website that is a poster consisting of a grid of squares. Every square represents a week of our lives, of which on average most people live around 4000 weeks. If we invest £100 per week in an investment fund for 520 weeks (or 10 years), that is a large proportion of our 4000 weeks. Successful compounding and patience come hand in hand.

Compounding Outside Of Investment:

One of the best ways we can experience compounding in our lives is through habits. Whether 21 days or 30 days, once we form habits, over time if we maintain them they become second nature. Eventually, we become better than 99% of the population without even a second thought. This is how effort, discipline, and habits can compound our lives.

So how else can we use compounding returns in our lives:

Education, Skills and Knowledge: Anytime we acquire information or skill, we naturally come across connected areas of knowledge and new skills to acquire. This accumulation of knowledge and skills contributes to personal growth over time and in turn more opportunities can present themselves to us.

Relationships: Building and maintaining relationships takes work. But through this consistent effort, our relationships grow deeper. We understand those around us better and they understand us. These deeper relationships can bring great happiness to our lives.

Health: Eating healthily, frequent physical exercise and healthy mental health practices can lead to compounding returns for our health and well-being. We can see physical compounding returns through eating healthily and working out, and we’re less likely to develop illnesses in later life.

Savings: Like with investments, our savings can compound through interest. For the first time in many years, this is now a possibility, if you have a nice bank!

Automation and Compounding

Once we reach a point where we understand how our habits work, how we can progress our habits, and they become key parts of our life systems. The end aim of efficiency with our habits is to automate them. Once we automate some habits, while maintaining the same level of performance, we can move on to gaining other skills and building new habits. All this is on the way to achieving mastery of a specific skill or area of knowledge.

The best time to start was years ago. The second best is now. So start now. One of my favourite quotes of this week applies to compounding:

“Showing up early costs very little and pays off handsomely in the long run”.